Diane Ravitch's Blog: Arizona: Universal Vouchers Are a Subsidy for Wealthy Families

Vouchers were originally sold as a way to “save” poor children of color from failing schools. We now know that this claim is not true. Poor kids who use vouchers typically fall behind their peers in public school. In state after state, vouchers are subsidizing students who are already enrolled in private schools and never attended public schools. The funding of vouchers takes money away from the public schools attended by most students, meaning larger classes, fewer resources.

The latest report from the Grand Canyon Institute in Arizona identifies a familiar pattern:

POLICY BRIEF

November 6, 2022

Nearly Half of Universal Voucher Applicants are from Wealthier Communities as Total State Private School Subsidies Reach $600M

Dave Wells, Research Director

Curt Cardine, Research Fellow

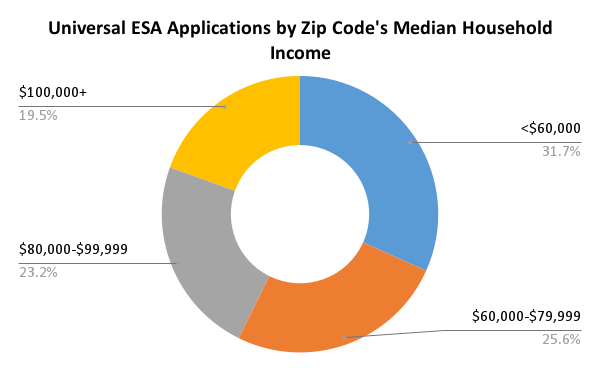

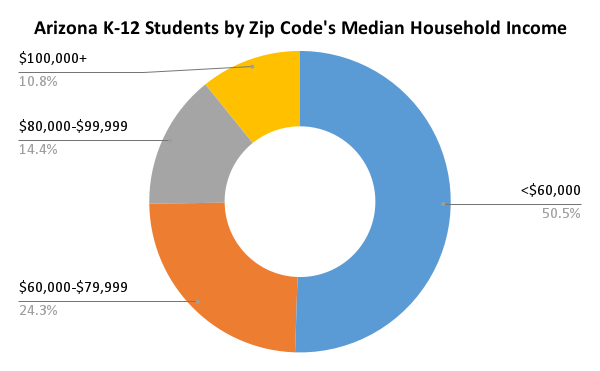

Distribution of Universal ESAs vs. Distribution of Students

Key Findings:

- 45% of universal Empowerment Scholarship Account (ESA) applicants come from the wealthiest quarter of students in the state. Their families live in zip codes where the median household income is $80,000 or more, more than 30% greater than the state’s median income.

- 32% of universal ESA applicants are from families with a median income less than $60,000, which comprise just over half the students in the state.

- 80% of universal ESA applicants are not in public school, meaning these students are already attending private schools, being home schooled, or just entering schooling. At a cost of about $7,000 per voucher this equates to potential new cost to the state of $177 million.

- Arizona will spend more than $600 million on private school subsidies—universal ESAs and Student Tuition Organization Scholarships—in the 2022-23 school year.

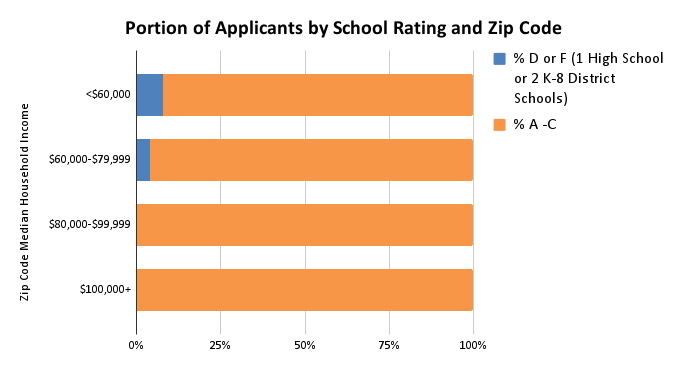

- Only 3.5% of all applicants came from zip codes that had a district high school or 2 K-8 district schools with a D or F grade. No zip codes with a median income above $80,000 had a district high school or 2 K-8 district schools receiving a D or F grade.

- There will be an increased risk of fraud with lax oversight to ensure that families don’t double dip by using both ESA and STO scholarship funds.

Universal Vouchers Primarily Benefit Wealthier Households

Now that the October 15, 2022 deadline to apply has passed, the Grand Canyon Institute (GCI) has analyzed the zip code distribution of applications for the new universal Empowerment Scholarship Account (ESA) voucher program that Gov. Ducey signed into law in July. GCI’s analysis finds that the program’s primary beneficiaries are students from wealthier families, similar to its previous analysis before the deadline, and that 92.5% of those students have access to well-performing schools.

Zip codes were provided by the Arizona Dept. of Education for universal voucher applicants. The total number of universal voucher applicants numbered 31,750. From that number GCI deducted 69 that were either out of state or had left the zip code blank. This report updates an earlier GCI analysis published on October 6. In September, GCI evaluated details of the program, including the inability to measure academic impacts of the program due to the absence of accountability measures in the legislation. Academic impacts were also part of a 2018 GCI report regarding Arizona’s private school subsidy programs.

GCI compared the distribution of applications to both the median household income as well as the distribution of K-12 students in the zip codes of applicants using data from the 2020 American Community Survey by the U.S. Bureau of the Census.

As noted in the graphs below, about 45% of all applications come from parents or guardians residing in zip codes that have a median household income of $80,000 or more, more than 30% greater than the state’s median household income.($61,529) These represent the wealthiest quarter of students in the state (gold and silver parts of the graphs). This is similar to GCI’s October analysis.

By contrast, parents or guardians in zip codes with a median household income less than $60,000 which comprise just over half the students in the state, represent not quite one-third of all applications (blue section). This is also similar to GCI’s October analysis.

Gov. Ducey in his press release after signing the universal voucher expansion noted, “This is a monumental moment for all of Arizona’s students. Our kids will no longer be locked in under-performing schools.” GCI examined this claim by identifying zip codes that either contained a district high school with a D or F grade OR had at least two K-8 district schools with a D or F grade. One school with a D or F grade hardly speaks poorly for a zip code. For instance, one Kyrene District elementary school in 85284 (South Tempe) received a “D,” but that is not indicative of the very highly rated schools in that relatively affluent zip code. Zip codes typically have many schools, so even in the D or F zip codes, most schools (district or charter) did not receive a D or F. Consequently, GCI’s D or F zip code identifier understates school grades within those zip codes.

GCI found only 3.5% of all applicants came from zip codes that had a high school or 2 K-8 schools with a D or F grade. No zip codes with a median income above $80,000 had a high school or 2 K-8 schools receiving a D or F grade.

These results belie the claim that the program was primarily designed for average and lower income families. Rather, similar to the flat tax passed by the legislature, the primary beneficiaries of this government policy are wealthier families.

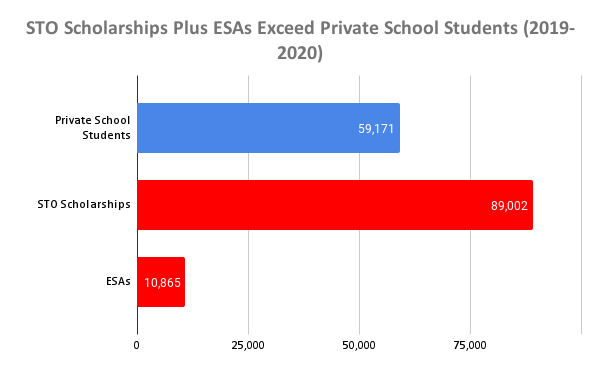

Total Private School Subsidies $600 Million

($180 Million from Universal ESAs)

Arizona has extensive subsidy programs for private schools. Dollar-for-dollar tax credit donations to private Student Tuition Organizations amounted to $250 million in FY2021 from individuals and corporations. In addition, the existing ESA program which serves a large number of students with disabilities was on track to cost the state at least $190 million plus administrative costs for FY2023 based on program growth. Collectively private school subsidies likely cost at least $440 million since tax credit data was less current.

Universal voucher access looks to add up to $180 million to that number taking the total cost of private school subsidies to in excess of $600 million dollars.

The Arizona Department of Education reports that about 80% of universal ESA applicants are not in public school, meaning these students are already attending private schools, being home schooled, or just entering schooling. At a cost of about $7,000 per voucher this equates to a cost of $177 million.

The remaining 20% of applicants are currently attending public district or charter schools. The voucher formula provides 90% of the state’s per pupil funding formula for charter schools plus charter additional assistance. While students moving from charters to private schools represent a net savings of about $700, vouchers to students who attended district schools represent a net cost to the state’s general fund. The voucher exceeds what the state is currently paying because district additional assistance is significantly less than charter additional assistance. Charter additional assistance is between $2,000 and 2,300 per pupil while district additional assistance is between $500 and $550. The difference exceeds the 10% overall reduction from charter payments for vouchers. In addition, students moving from wealthier district schools cost the state even more. Under the state’s education equalization formula their districts rely primarily on local property taxes, not state funding.

Movement from charter schools is more likely to occur, from GCI’s past analysis. However, the loss from district movement is significantly more, such that it’s likely to be an overall net cost to the state.

An unknown number of these students may already be using the STO private school scholarship program, so some parents may switch to ESAs which would reduce the net cost to the state. Likewise, not every applicant may qualify.

The estimated total cost of up to $180 million is significantly higher than the $33.4 million projected by the Joint Legislative Budget Committee for FY2023. The 31,7500 applicants are more than five times what the Joint Legislative Budget Committee projected of about 5,800 applicants in the first year of the program. The JLBC estimate though was very rough and saw the program doubling in year two.

STO scholarship award amounts are likely to increase in order for them to stay more competitive with the universal ESAs and because the number of of STO scholarship applicants may decline. Keep in mind, STO scholarships are administered by privately-run organizations that can take up to 10% of tax credit donations to cover administrative costs. Universal ESAs represent competition for their business. Some past STO scholarship awardees may switch to the universal ESA program, which could reduce contributions to STOs (it was common for STO donors to contribute on behalf of a particular recipient), but since the tax credit costs contributors nothing, they may persist.

Many of the new applicants are likely homeschooled students, which the JLBC had estimated at 38,000 who are now eligible for state funding.

Risk of Misuse Rises Significantly

Two potential issues arise with universal vouchers that might fall under the general category of fraud-whether pursued civilly or more likely with internal enforcement-relates to violations of the ESA contract. These occur if an ESA recipient were to misspend monies or double dip by receiving an STO scholarship simultaneously in violation of the ESA contract. Since ESAs go through the Department of Education, students are well tracked. An audit process is designed to prevent misspent dollars.

As GCI noted in September, already a number of permitted ESA expenses are questionable. But with a wider program that expands to homeschool, such oversight may be more challenging. Parents or guardians accepting ESAs sign a contract where they also agree not to accept an STO scholarship. However, the state does not track recipients of STO scholarships outside broad aggregate reporting to the Arizona Department of Revenue. It has been evident for a number of years that many parents or guardians seek and receive scholarships from multiple STOs, such that in 2019-2020 about 90,000 scholarships were awarded to around 50,000 private school students who were not receiving an ESA voucher (see diagram above). While some parents or guardians may not currently be in compliance with this restriction, the narrower scope of ESA eligibility limited that opportunity. However, with universal vouchers, the potential that a parent or guardian might attempt to double dip from both the ESA and STO scholarship programs rises significantly and an effective mechanism to catch when that occurs does not appear to exist.

Download PDF of paper including footnotes.

For more information, contact:

Dave Wells, Research Director

dwells@azgci.org, 602.595.1025, Ext. 2

The Grand Canyon Institute (GCI) is a nonpartisan, nonprofit organization dedicated to informing and improving public policy in Arizona through evidence-based, independent, objective, nonpartisan research. GCI makes a good faith effort to ensure that findings are reliable, accurate, and based on reputable sources. While publications reflect the view of the institute, they may not reflect the view of individual members of the board.

This blog post, which first appeared on the

website, has been shared by permission from the author.

Readers wishing to comment on the content are encouraged to do so via the link to the original post.

Find the original post here:

The views expressed by the blogger are not necessarily those of NEPC.